Life Insurance in and around Independence

Coverage for your loved ones' sake

What are you waiting for?

Would you like to create a personalized life quote?

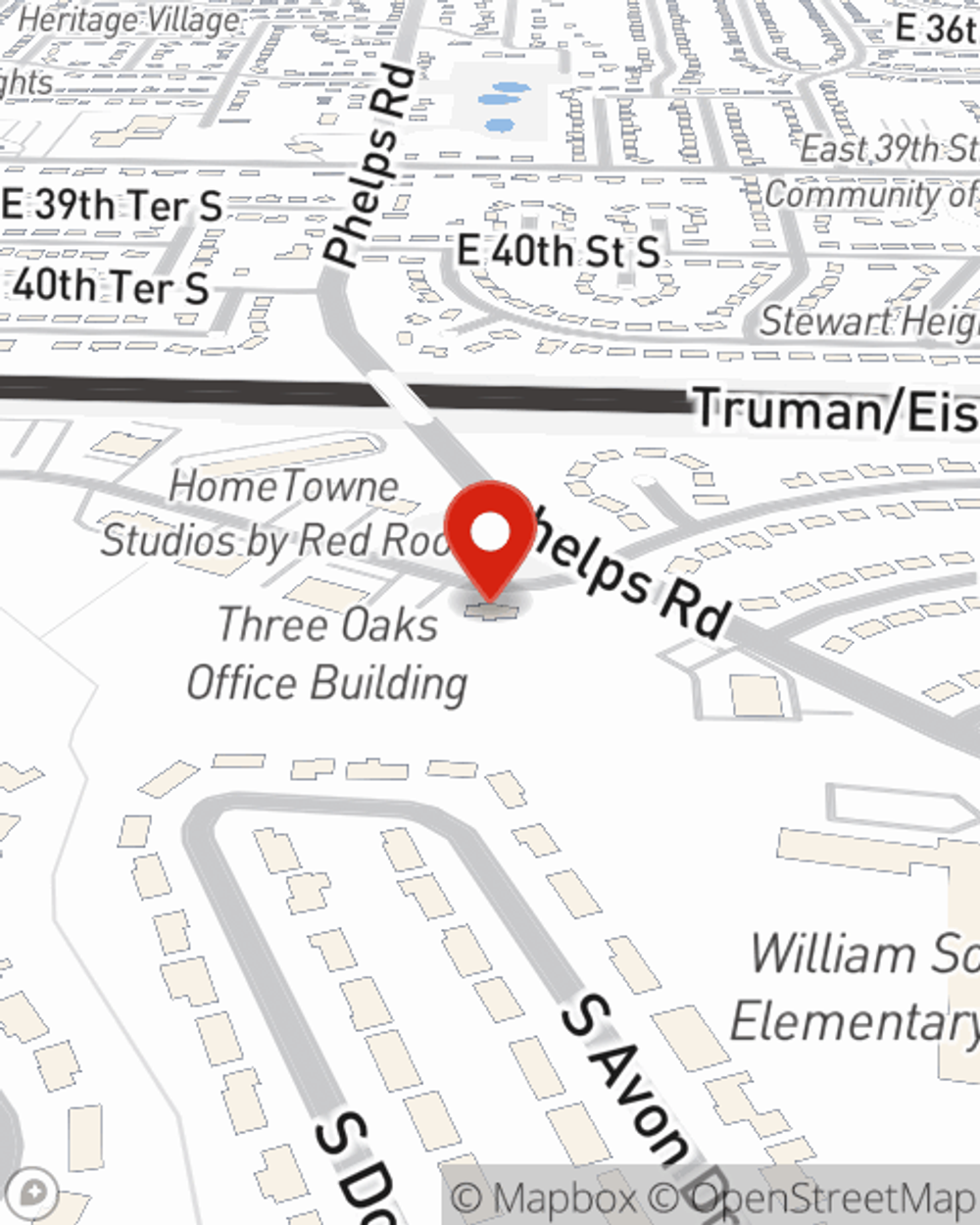

- Independence

- Blue Springs

- Sugar Creek

- Lees Summit

- Buckner

- Kansas City

- Jackson County

State Farm Offers Life Insurance Options, Too

It can be what keeps you going every day to provide for your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your partner can pay for college and/or pay off debts as they grieve your loss.

Coverage for your loved ones' sake

What are you waiting for?

State Farm Can Help You Rest Easy

And State Farm Agent Chad Mitchell is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific number of years. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to experience what the State Farm brand can do for you? Contact State Farm Agent Chad Mitchell today.

Have More Questions About Life Insurance?

Call Chad at (816) 836-0114 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Chad Mitchell

State Farm® Insurance AgentSimple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.